south san francisco sales tax rate 2021

The minimum combined 2022 sales tax rate for South San Francisco California is. 850 Is this data incorrect The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc.

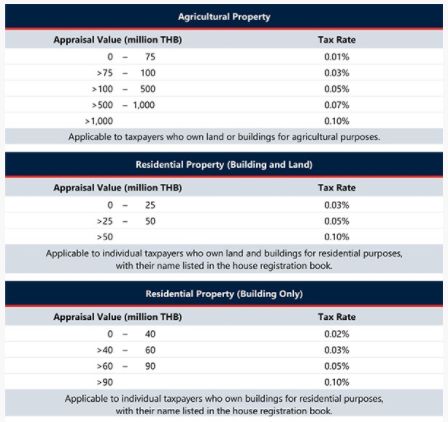

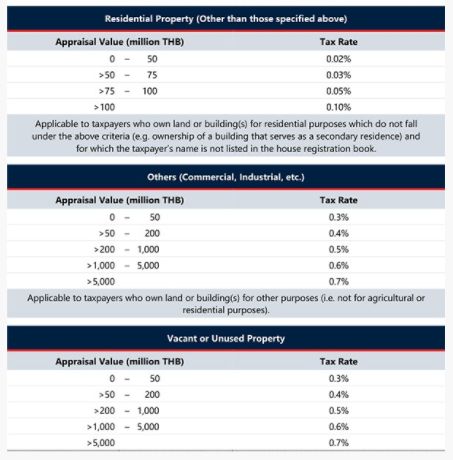

No Change For Thailand S Land And Building Tax Rates For 2022 Property Taxes Thailand

For questions regarding property tax collection please call 650 363-4142.

. The December 2020 total local sales tax rate was 8500. San Mateo Co Local Tax Sl 1. The sales and use tax is rising across california including in san francisco county.

The average sales tax rate in California is 8551. The minimum combined 2021 sales tax rate for south san francisco california is. 5192021 120245 PM.

The minimum combined sales tax rate for San Francisco California is 85. Method to calculate South San Francisco sales tax in 2021. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

4 rows The current total local sales tax rate in South San Francisco CA is 9875. It was raised 0125 from 975 to 9875 in July 2021. Depending on the zipcode the sales tax rate of south san francisco may vary from 65 to 9875 depending on the zipcode the sales tax.

The California sales tax rate is currently 6. How much is sales tax in San Francisco. Wwwcdtfacagov and select Tax and Fee Rates.

The phone number for general tax questions is 1-800-400-7115. Most of these tax changes were approved by voters in the November 2020 election the California Department of Tax and Fee Administration said. South San Francisco Sales Tax Rate 2021.

South Shore Alameda 10750. What is the sales tax rate in South San Francisco California. The San Francisco Tourism Improvement District sales tax has been changed within the last year.

The California state sales tax rate is currently 6. 4 rows The 85 sales tax rate in San. The County sales tax rate is 025.

1788 rows California City County Sales Use Tax Rates effective April 1 2022. South San Francisco 9875. 2021 State Sales Tax Rates California has the highest state-level sales tax rate at 725 percent.

The South San Francisco California sales tax is 750 the same as the California state sales tax. What is the sales tax rate in San Francisco County. A yes vote was a vote in favor of increasing the local hotel tax incrementally from 10 percent to 14 percent in 2021 with funds used for general city purposes.

The California sales tax rate is currently. The South San Francisco sales tax rate is. The Sales and Use tax is rising across California including in San Francisco County.

The secured property tax rate for Fiscal Year 2021-22 is 118248499. It was raised 0125 from 975 to 9875 in July 2021. The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco.

Click here to find. 2021 local sales tax rates. Santa Clara County This rate applies in all unincorporated areas and in.

This is the total of state county and city sales tax rates. In San Francisco the tax rate will rise from 85 to 8625. 1788 rows san francisco 8625.

This is the total of state and county sales tax rates. Go to our website at. The County sales tax rate is 025.

It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021. The minimum combined 2022 sales tax rate for San Francisco County California is 863. By wilson walker july 1 2021 at 701 pm.

The South San Francisco sales tax has been changed within the last year. How much is sales tax in San Francisco. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

The County sales tax rate is. New Sales and Use Tax Rates Operative July 1 2021 Created Date. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Those district tax rates range from 010 to 100What is the sales tax in California 20217252021 Local Sales Tax RatesA Presidio San Francisco Sales Tax Calculator For 2021 December 28 2021 at 430 am. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. San francisco ca sales tax rate the current total local sales tax rate in san francisco ca is 8625.

Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and remitted to the City. The average sales tax rate in California is 8551. As of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and.

City of South San Francisco. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. CHICO The city of Chico is proposing a ballot measure set for the November 2022 election that would raise the local sales tax by.

Method to calculate Simi Valley sales tax in 2021. Did South Dakota v. This is the total of state county and city sales tax rates.

The December 2020 total local sales tax rate was 8500. The California sales tax rate is currently. Sales Use Tax Rates.

California City County Sales Use Tax Rates

I Overview In Tax Harmonization In The European Community

States With Highest And Lowest Sales Tax Rates

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Sales Tax On Saas A Checklist State By State Guide For Startups

How Much Tax Do You Pay When You Sell Your House In California Property Escape

Sales Tax Rates In Major Cities Tax Data Tax Foundation

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

I Overview In Tax Harmonization In The European Community

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California Sales Tax Small Business Guide Truic

California Sales Tax Rates By City County 2022

No Change For Thailand S Land And Building Tax Rates For 2022 Property Taxes Thailand

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Why Households Need 300 000 To Live A Middle Class Lifestyle

Transfer Tax In San Mateo County California Who Pays What

Chicago Il Cost Of Living Is Chicago Affordable Data